The Benefits of Pet Insurance: Peace of Mind

Building an Emergency Fund

Veterinary emergencies don't announce themselves. One evening your Beagle's happy and healthy; by morning, they've ingested something toxic. Aim to build a reserve covering six months of pet care expenses - this creates breathing room when seconds count.

Start small if needed. Even $20 weekly adds up to over $1,000 in a year - enough to handle many common emergencies.

Investing Wisely for the Future

Compound interest works magic for pet owners too. That $5,000 invested today could cover future cancer treatments or specialized surgeries. Diversify across index funds and high-yield accounts to grow your pet care nest egg.

Remember: The best investment is one that lets you say yes to life-saving treatment without hesitation.

Protecting Your Assets with Insurance

Pet insurance transforms unpredictable costs into manageable premiums. Policies covering 90% of emergency care cost less than many people spend on coffee monthly. It's the difference between financial catastrophe and manageable copays when facing a $8,000 surgery bill.

Review policies annually as your pet ages - their needs will change, and so should their coverage.

Managing Debt Effectively

High-interest credit cards become emergency funds of last resort. Attack these balances aggressively - every dollar saved on interest becomes available for your pet's wellness.

Consider this: The interest saved by paying off one credit card could fund a year's worth of heartworm prevention.

Ensuring High-Quality Veterinary Care

Maintaining Optimal Hygiene Standards

Hospital-acquired infections kill more pets than many realize. Notice if staff wash hands between patients and disinfect surfaces thoroughly - these details reveal a clinic's true standards.

Ask about their sterilization protocols. Top clinics will proudly explain their autoclave cycles and isolation procedures for contagious cases.

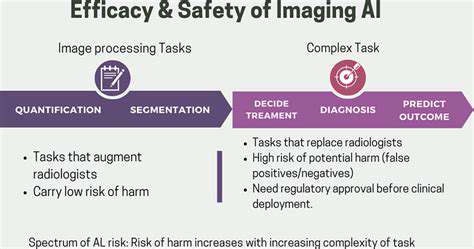

Employing Advanced Diagnostic Tools

Modern diagnostics catch problems invisible to the naked eye. Digital X-rays detect subtle fractures; ultrasounds reveal internal abnormalities before symptoms appear. Clinics investing in CT scanners provide specialists with 3D views that dramatically improve surgical planning.

Don't hesitate to ask what diagnostic tools are available - your pet deserves nothing less than precise answers.

Providing Comprehensive Treatment Plans

Exceptional vets present clear roadmaps. A thorough plan details medications with exact dosages, follow-up timelines, and warning signs requiring immediate attention. It anticipates questions before you ask them.

Beware vague instructions like give antibiotics. Quality care specifies the drug, dose frequency, and duration precisely.

Enhancing Patient Communication

Great vets speak both medical truth and compassion. They'll explain complex conditions using analogies you understand while allowing time for all your questions. Look for staff who return calls promptly and provide written summaries.

Notice if they discuss cost options transparently - financial empathy matters when making tough decisions.

Promoting Preventive Veterinary Care

Prevention costs pennies compared to treatment dollars. Sophisticated practices recommend breed-specific screening tests before problems develop. For example, cardiac exams for Maine Coons or joint assessments for German Shepherds.

Ask about wellness packages - bundling services often saves money while ensuring nothing gets overlooked.

Fostering Collaboration and Continuous Learning

Top clinics participate in veterinary journal clubs and attend cutting-edge conferences. Their treatment plans incorporate the latest peer-reviewed research, not outdated protocols. Staff certifications should be current and visible.

Don't hesitate to ask about their continuing education commitments - your pet benefits from this knowledge.

Customized Coverage for Your Pet's Needs

Tailored Health Plans

Cookie-cutter pet insurance often misses critical breed-specific needs. Great plans adjust for your Boxer's heart risks or your Dachshund's spinal vulnerabilities. They don't charge the same premium for a Chihuahua and a Great Dane.

Review exclusions carefully - some policies won't cover conditions common to certain breeds.

Preventive Care Packages

Smart packages bundle services predictably needed at each life stage. Puppy plans should include multiple vaccine rounds; senior packages need semiannual bloodwork. These aren't upsells - they're cost-saving measures.

Calculate the à la carte cost versus package pricing - the savings often surprise you.

Emergency Preparedness

True emergency coverage means knowing exactly where to go at 2 AM. Quality providers give 24/7 telehealth access and clear instructions for after-hours crises. They pre-authorize emergency clinics in your network.

Test their emergency response - call the after-hours line to gauge wait times and advice quality.

Wellness Programs for Specific Breeds

Bulldog plans must address breathing issues; Greyhound packages need special anesthesia protocols. Breed-specific providers understand these nuances deeply. Their recommendations reflect generations of specialized knowledge.

Ask how their plan differs for your pet's breed - generic answers reveal lack of expertise.

Specialized Plans for Senior Pets

Gold-standard senior care includes twice-yearly comprehensive blood panels. These catch kidney decline or diabetes early, when interventions work best. Mobility supplements and therapeutic diets should be covered.

Compare coverage for chronic conditions - some policies cap reimbursements unfairly.

Dental Care Integration

Dental disease causes systemic inflammation affecting major organs. Comprehensive plans cover cleanings plus extractions when needed. They don't classify dental care as cosmetic.

Ask about anesthesia protocols - proper dental work requires safe sedation.

Nutritional Support Options

Custom diets address more than weight. Renal-support formulas, joint-health blends, and allergy-specific foods should be covered. The right nutrition prevents expensive conditions.

Check if plans cover prescription diets - these often cost more but deliver targeted benefits.