Your Personalized Financial Wellness Plan: Reducing Stress, Building Security

Implementing and Monitoring Your Plan for Long-Term Success

Planning for Long-Term Financial Stability

A crucial aspect of long-term financial success is developing a comprehensive plan that addresses your current financial situation and anticipates future needs. This involves more than just saving; it requires a strategic approach that considers factors such as income, expenses, debt, desired lifestyle, and potential future events like education costs, homeownership, or retirement. Thorough research into investment options, understanding risk tolerance, and diversifying your portfolio are integral to this process. By proactively planning for the future, you create a solid foundation for achieving your financial goals and building a secure future.

Regularly reviewing and adjusting your plan is essential. Economic conditions, personal circumstances, and market fluctuations can impact your financial strategy. Flexibility and adaptability are key components of a successful long-term financial plan. This means being prepared to make necessary adjustments to your savings, investments, and spending habits as your life circumstances evolve. Consistently evaluating your progress and staying informed about relevant financial trends will help you stay on track to meet your goals.

Implementing and Monitoring Your Plan Effectively

Implementing your financial plan involves translating your goals into actionable steps. This might include creating a budget, automating savings contributions, paying down high-interest debt, and exploring investment opportunities. The key is to choose strategies that align with your financial capabilities and long-term objectives. Consistency in implementing your plan, even if it's small steps at first, is crucial for sustainable success.

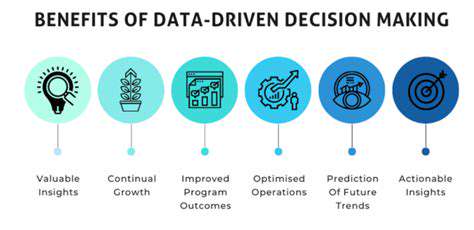

Monitoring your progress is just as important as implementing your plan. Regular reviews of your budget, savings, and investments are vital to ensure you're on track and identify any necessary adjustments. Regular communication with a financial advisor can also provide valuable insights and support in navigating financial challenges. By staying vigilant and actively monitoring your progress, you can make informed decisions and maintain the momentum towards achieving your financial goals.

Tracking your progress allows you to celebrate milestones and make necessary course corrections along the way. This feedback loop ensures that your plan remains aligned with your evolving needs and circumstances. By understanding your financial performance and proactively addressing any deviations, you can maintain the path to long-term financial stability and success. Don't be afraid to seek professional guidance if needed.

Using financial tools and technology can help streamline this process. From budgeting apps to investment platforms, these resources can help you track your progress, stay organized, and make informed decisions about your finances. Leveraging technology can make the process more efficient and more accessible, enabling you to focus on the bigger picture of your financial well-being.

Read more about Your Personalized Financial Wellness Plan: Reducing Stress, Building Security

Hot Recommendations

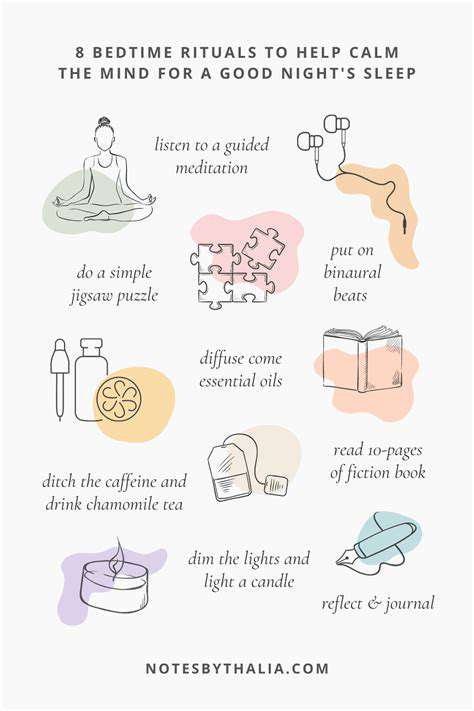

- Customized Sleep Schedules: AI Driven for Sustainable Rest

- Crafting a Personalized Productivity Plan for Mental Clarity

- Sustainable Self Compassion: Cultivating Kindness Towards Your Mind

- Sustainable Productivity Hacks for the Busy Professional

- Sustainable Wellness for Parents: Balancing Family and Self Care

- Data Informed Self Care: Designing Your Personalized Wellness Strategy

- Sustainable Wellness for a Purpose Driven Life

- AI Assisted Mindfulness: Personalized Meditations for Deeper Practice

- Building Inclusive Mental Health Services: Key Initiatives

- AI Powered Self Care: Customizing Your Routine for Maximum Impact