Creating a Business Plan for Your Pet Venture: Step by Step

Creating a Robust Financial Plan: Budgeting and Projected Revenue

Defining Your Financial Goals

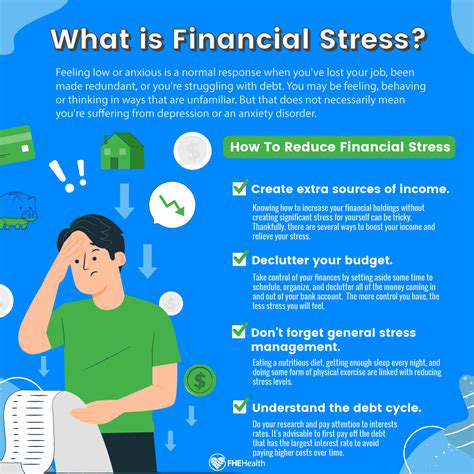

A robust financial plan starts with clearly defined goals. These goals should encompass all aspects of your financial life, from short-term needs like saving for a down payment on a house to long-term aspirations like retirement security. Identifying and prioritizing these goals is crucial for creating a plan that truly works for you. Consider factors like your current income, expenses, and any debts you might have when determining realistic and achievable targets.

It's important to remember that your financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of a vague goal like save for retirement, a SMART goal might be save $50,000 in retirement savings within the next five years. This level of specificity allows you to track your progress and make adjustments as needed.

Developing a Budget and Tracking Expenses

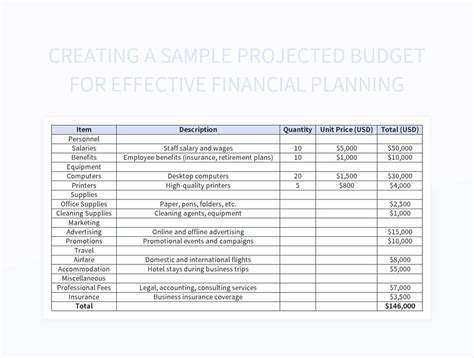

A comprehensive budget is the cornerstone of any successful financial plan. It involves meticulously listing your income sources, fixed and variable expenses, and allocating funds towards your financial goals. Understanding where your money is going is essential for identifying areas where you can cut back or save more. A well-maintained budget provides a clear picture of your financial health and allows for proactive adjustments.

Beyond simply creating a budget, it's vital to track your expenses consistently. This allows you to monitor how closely your spending aligns with your budget. Using budgeting apps or spreadsheets can make this process much easier and more efficient. Tracking expenses provides valuable insights into spending habits, helping you identify areas where you can make changes to better manage your finances.

Investing and Managing Debt

Investing wisely can significantly boost your long-term financial well-being. Understanding different investment options, such as stocks, bonds, and mutual funds, and assessing your risk tolerance is crucial for making informed decisions. Diversification is key to mitigating risk and maximizing potential returns. Seeking professional financial advice can be invaluable in navigating the complexities of investing.

Managing debt effectively is another critical aspect of a strong financial plan. Prioritize high-interest debts and explore strategies for debt reduction, such as balance transfers or debt consolidation. A proactive approach to debt management can free up valuable funds and improve your overall financial health. Paying off debt strategically can significantly improve your credit score and free up additional resources for savings and investments.

Marketing and Sales Strategy: Reaching Your Target Audience

Defining the Target Audience

Understanding your target audience is paramount to a successful marketing and sales strategy. It's not enough to simply identify who you're selling to; you need to delve deeper into their needs, motivations, and pain points. This detailed understanding allows for the development of targeted messaging and tailored products or services that resonate with their desires. By deeply analyzing their demographics, psychographics, and buying behaviors, you can craft a marketing campaign that speaks directly to their unique requirements.

Identifying their specific pain points and how your product or service alleviates them is crucial for effective marketing. This will help you craft compelling messaging that positions your offering as the ideal solution to their problems. A clear understanding of the target audience will lead to higher conversion rates and a more effective overall marketing strategy.

Developing a Compelling Value Proposition

A robust value proposition is the cornerstone of any successful marketing campaign. It clearly articulates the unique benefits your product or service offers to the target audience, differentiating it from competitors. This involves highlighting the key advantages and emphasizing how it addresses their specific needs and pain points. The value proposition should be concise, persuasive, and easily understandable, leaving a lasting impression on potential customers.

A well-defined value proposition is essential for attracting and retaining customers. It acts as a beacon, guiding potential customers towards your brand and highlighting the specific value they can expect from engaging with your business. This concise and impactful message is the driving force behind customer acquisition and loyalty.

Crafting a powerful value proposition requires deep understanding of your target audience, your product's unique features, and the competitive landscape. It should be reflected in all aspects of your marketing materials, from your website to your social media posts.

Highlighting the key differentiators that set your product or service apart from the competition will make your value proposition stronger. This will establish your brand as the go-to solution in the market, attracting the ideal customers and driving revenue growth.

Implementing Effective Marketing Channels

Choosing the right marketing channels is crucial for reaching your target audience effectively. A comprehensive strategy should utilize a blend of online and offline channels, tailoring your approach to the specific preferences and behaviors of your target audience. This might include social media marketing, search engine optimization (SEO), content marketing, email marketing, and paid advertising, among other options.

Careful consideration should be given to which channels best align with your budget and resources. Analyzing which channels yield the best results for your specific audience is vital to optimizing your marketing spend and maximizing ROI. Tracking key metrics and regularly evaluating performance is essential for adapting your strategy over time.

Understanding the nuances of each channel and its strengths will allow you to make the most effective use of your resources. This includes knowing where your target audience spends their time online and offline, and tailoring your message to resonate in those specific contexts. This refined approach will lead to increased engagement and ultimately greater conversion rates.

Read more about Creating a Business Plan for Your Pet Venture: Step by Step

Hot Recommendations

- Customized Sleep Schedules: AI Driven for Sustainable Rest

- Crafting a Personalized Productivity Plan for Mental Clarity

- Sustainable Self Compassion: Cultivating Kindness Towards Your Mind

- Sustainable Productivity Hacks for the Busy Professional

- Sustainable Wellness for Parents: Balancing Family and Self Care

- Data Informed Self Care: Designing Your Personalized Wellness Strategy

- Sustainable Wellness for a Purpose Driven Life

- AI Assisted Mindfulness: Personalized Meditations for Deeper Practice

- Building Inclusive Mental Health Services: Key Initiatives

- AI Powered Self Care: Customizing Your Routine for Maximum Impact